I recently had the opportunity to work with a client who sought social media management and campaign management. Instead of jumping straight into content creation, I proposed we start with a thorough analysis of their competitors.

What we uncovered was eye-opening. Almost all competitors were echoing the same tired messages, targeting the same audiences, and using the same channels. It was a sea of sameness.

However, amidst this monotony, we discovered hidden gems: key messages and untapped opportunities that no one else was addressing. So where to start when conducting such in-depth research?

Here is an outlined and detailed guide to creating a competitors analysis:

Stage 1: Listing Competitors

Together with the client, I mapped out both direct and indirect competitors to clarify who we’re up against. We then prioritized those most relevant within the client’s market space.

Stage 2: Messaging & Positioning

I examined competitors’ messaging across websites and social media, analyzing their tone, taglines, and positioning to understand what resonates with their target markets. This step is crucial to seeing how they differentiate themselves.

Stage 3: Target Audience Insights

I delved into the target audiences they’re aiming at, as reflected in their digital activity. This includes which industries they highlight on their websites and ads, and the companies and titles referenced in case studies and testimonials. These insights reveal where competitors are focused and help identify underserved segments.

Stage 4: Social Content Strategy

I broke down each competitor’s social media content to determine which formats perform best (videos, blogs, infographics, etc.), which themes they emphasize, and the timing and frequency that drive engagement.

Stage 5: Digital Channels & Ad Presence

I mapped the digital channels competitors use (Google Ads, LinkedIn, Facebook, X, YouTube, etc.) to understand their reach. Using tools like SEMrush and Similarweb, I estimated ad spend and examined where competitors focus their advertising. This provides a clear view of budget priorities and reveals opportunities for new or underutilized channels.

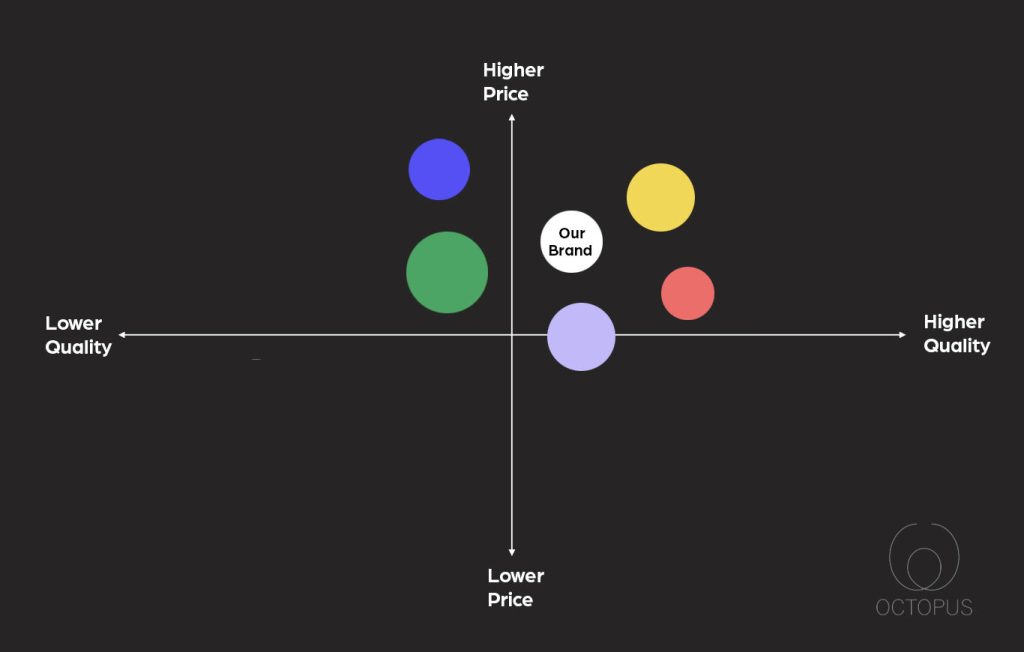

Stage 6: Competitive Landscape Visualization

This is where thinking and analyzing skills are required- creating a competitive landscape graph. I map competitors based on relevant categories, whether it’s positioning attributes like price, quality, innovation, target audience, or service quality and variety. This visualization helps us identify market gaps and potential unique spaces.

Stage 7: Actionable Recommendations

With all this data in hand, I create tailored recommendations for my clients. These include unique positioning ideas, content opportunities, channel priorities, and budget allocations. It’s all about helping clients stand out in a way that’s more than just repeating what others are doing.

Sometimes, the smartest first move in marketing is to understand the full landscape before acting.

Insight leads to impact.